Here you'll find quick answers to common questions about cross-broker fund transfers.

1. What is a fund transfer?

We currently support cross-broker fund transfers. If you hold accounts with both Longbridge Securities (Hong Kong) and Longbridge Securities (Singapore), you can transfer funds between them to avoid repeated deposits/withdrawals.

- Processing time: Expected within 1-2 working days. Note that due to different public holidays in Hong Kong and Singapore, the actual processing time depends on the working days of the destination broker’s location.

- Fees: Free of charge.

- Note: This feature is available only if you have accounts with Longbridge Securities (Hong Kong) and Longbridge Securities (Singapore).

2. How can I activate the cross-broker fund transfer authorization?

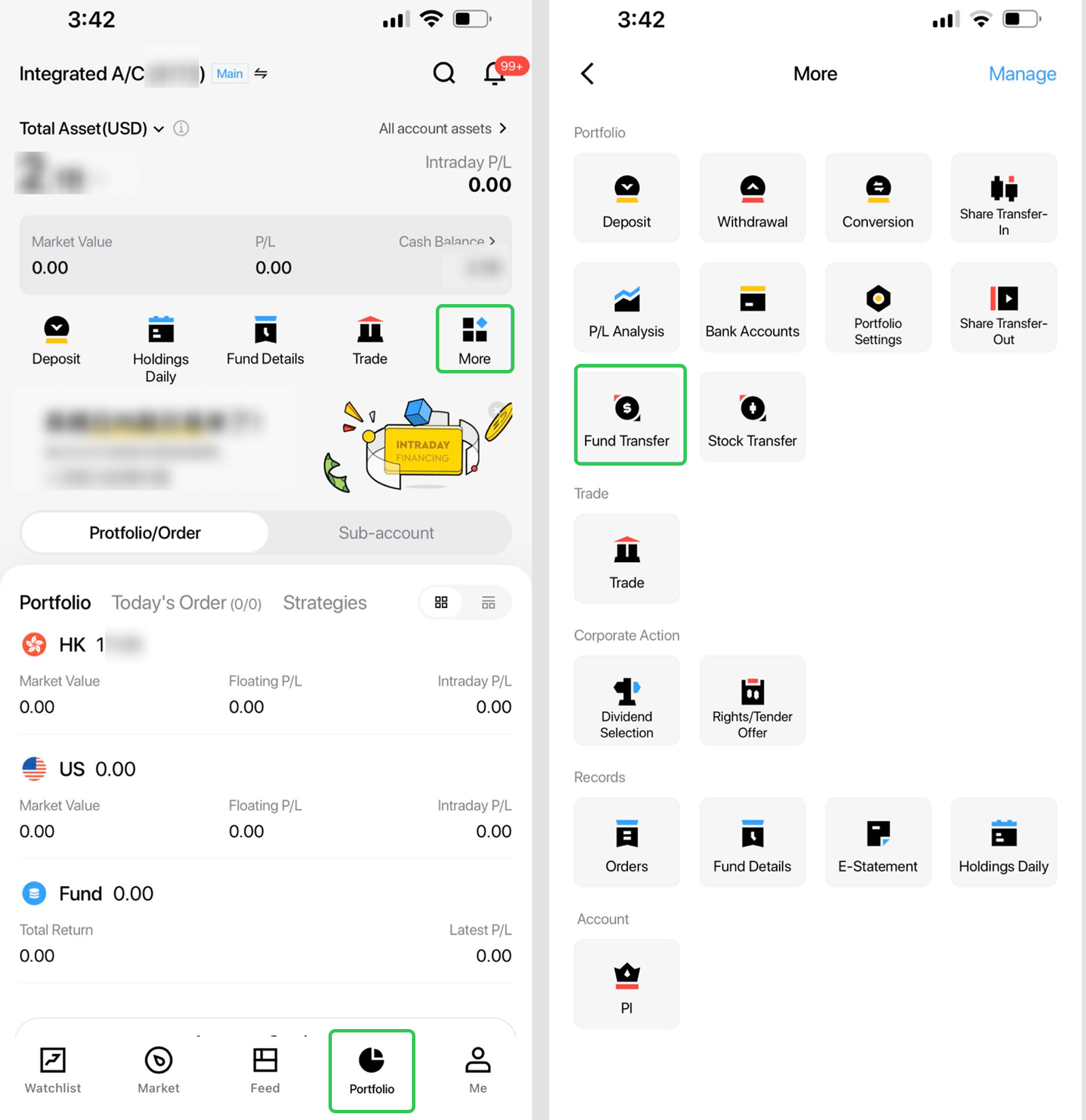

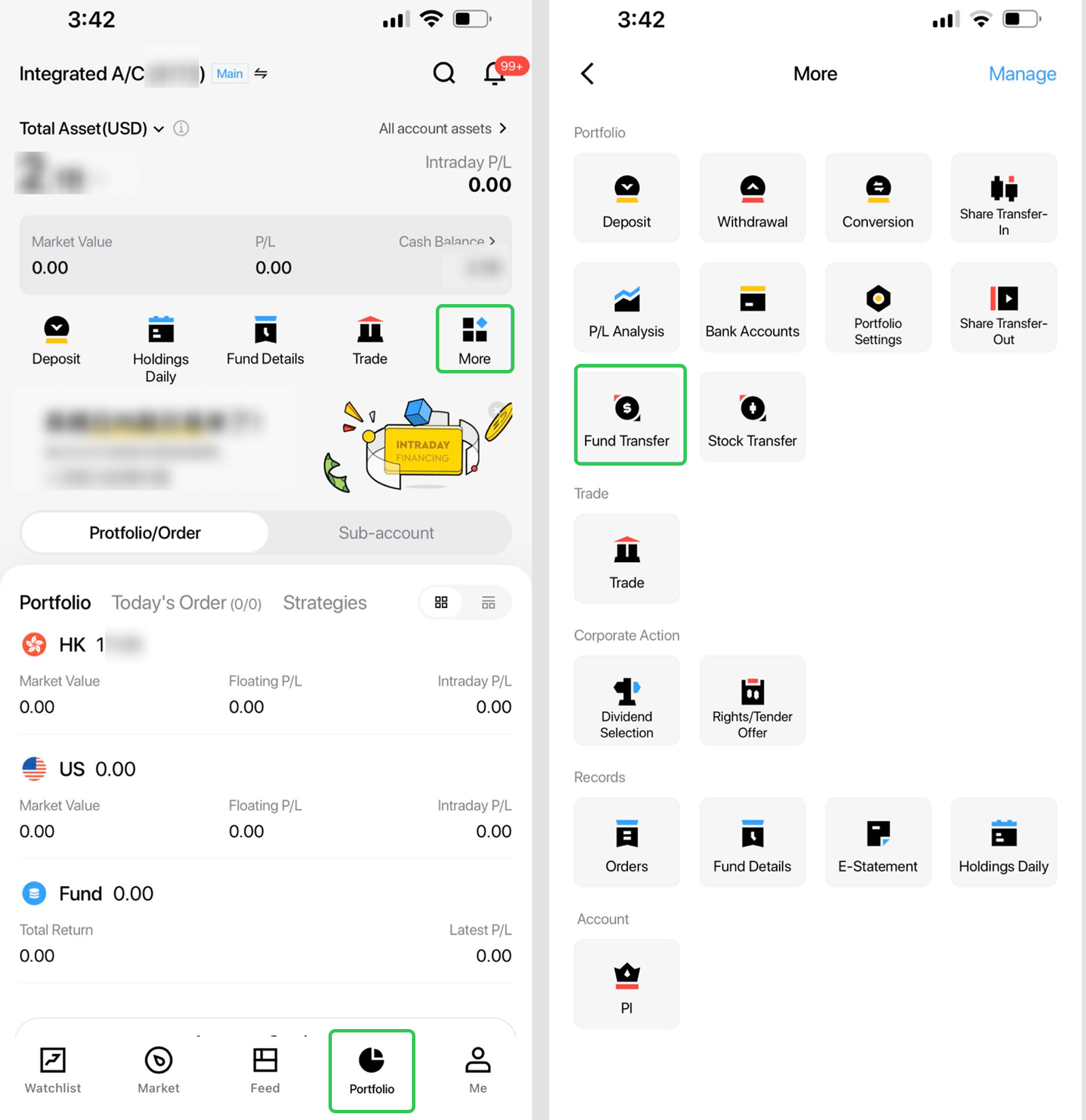

Step1. Locate the fund transfer feature on your Longbridge App.Go to Portfolio > More > Fund Transfer.

Step2. Initiate an authorization application.

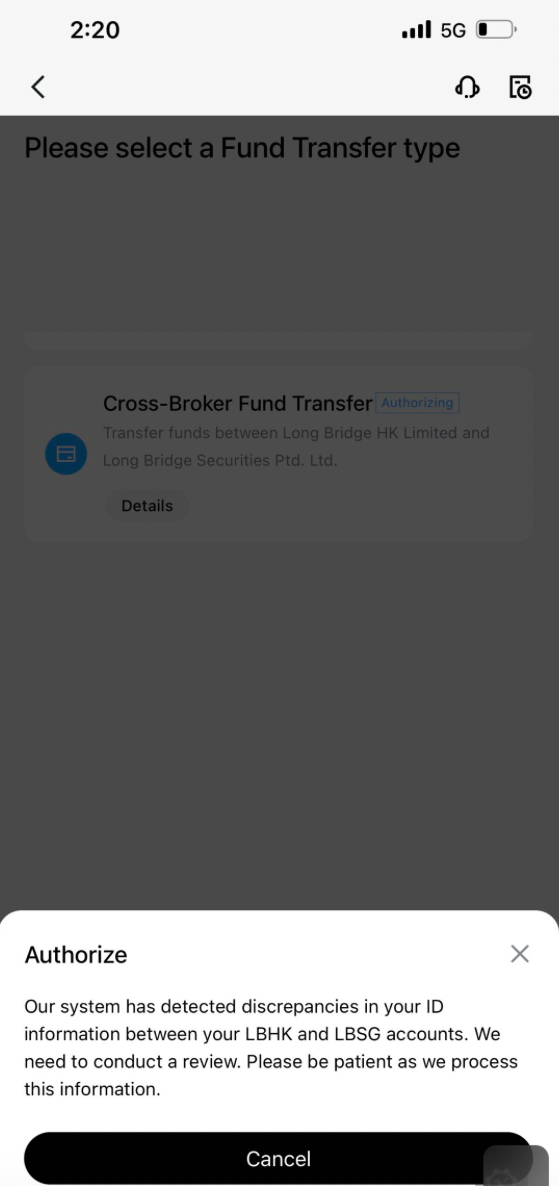

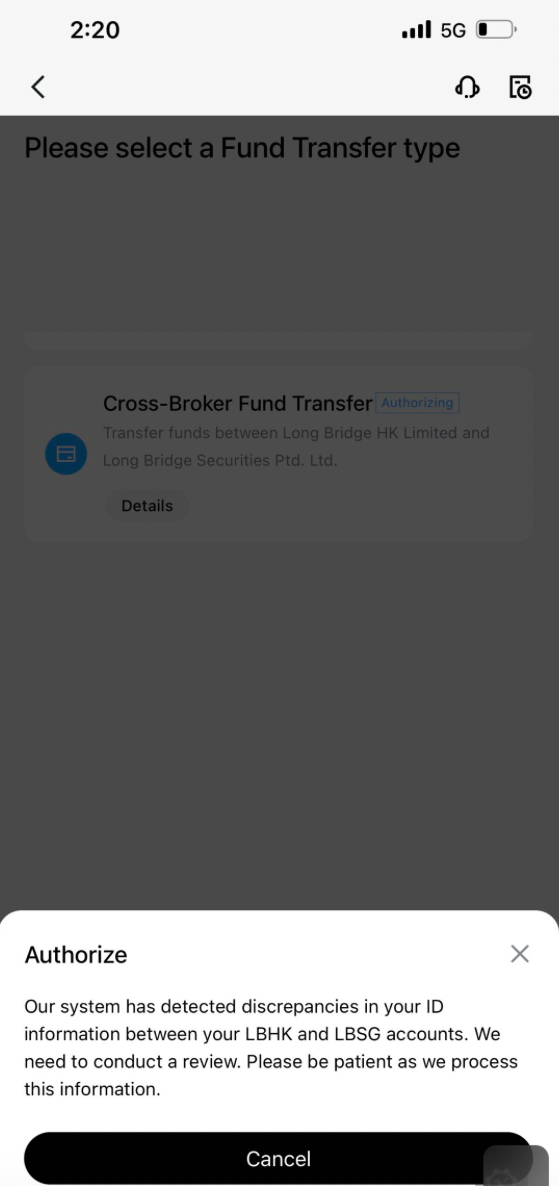

Select “Cross-Broker Fund Transfer” and initiate an authorization application. You must scroll to the bottom of the authorization agreement, confirm that your personal information is correct, and then click “Authorize now”.

This feature is available only if you have accounts with Longbridge Securities (Hong Kong) and Longbridge Securities (Singapore).

Step3. Successfully submitted fund transfer request.

i. If authorization is successful, select the destination account and source account, enter the transfer amount, confirm your details, and submit.

ii. Your transfer request will be submitted. Funds are expected to arrive within 1–2 working days. As public holidays differ between Hong Kong and Singapore, the actual processing time depends on the working days of the destination broker.

iii. If the funds are successfully transferred, you will receive a push notification and email message. You can also check progress on the transfer record details page. Securities account numbers starting with "H" denote Longbridge Securities (Hong Kong). Those starting with "SG" represent Longbridge Securities (Singapore).

Step4. Application requires manual review.

If the system detects that your account information in Longbridge Securities (Hong Kong) and Longbridge Securities (Singapore) is inconsistent, your application will be manually reviewed. Please be patient as this may take some time.

Step5. Application rejected as additional information is required.

If your authorization is rejected, you will receive a push notification and message prompt letting you know why the application has been rejected, as well as what other information to submit.

Please submit your supplementary information on the platform you used to initiate your authorization application.

3. Why can't I find the fund transfer feature?

Go to Portfolio > More > Fund Transfer > Cross-Broker Fund Transfer.

If it still does not work, it may be because:

- This feature is only available for the main account, not sub-accounts. Please switch to a main account.

- For Longbridge Securities (Singapore) accounts, if you’re using a version of the app older than 4.51.0, you may not be able to see the feature. Please upgrade to 4.51.0 and later.

4. Do I need to authorize my account on both platforms?

If you have initiated an authorization application via Longbridge Securities (Hong Kong) and it’s successful, you won’t have to complete another authorization for Longbridge Securities (Singapore). You may directly submit transfer requests from the Singapore platform.

5. Why can't I submit supplementary information?

Please submit your supplementary information on the platform you used to initiate your authorization application.

For example, if the authorization application you’ve initiated via Longbridge Securities (Hong Kong) is rejected, you can only add more information or cancel the authorization through your Hong Kong account. Your Singapore account will only display the authorization status.

Likewise, if the authorization application you’ve initiated via Longbridge Securities (Singapore) is rejected, you can only add more information or cancel the authorization through your Hong Kong account. Your Hong Kong account will only display the authorization status.

6. Why can't I cancel the authorization?

Authorizations must be cancelled on the platform it was initiated on. Please switch to the corresponding broker account (Hong Kong or Singapore) to do so.

7. Which fund transfer directions are currently supported?

Cross-broker transfers are available between Longbridge Securities (Hong Kong) and Longbridge Securities (Singapore).

- If you have logged in the Longbridge Securities (Hong Kong) account, transfers can only be sent from the Hong Kong account to the Singapore account.

- If you have logged in the Longbridge Securities (Singapore) account, transfers can only be sent from the Singapore account to the Hong Kong account.

8. How is the transferable amount calculated?

After you choose the source account and currency, the maximum transferable amount equals the withdrawable cash balance of that currency in the source account.

Withdrawable cash balance excludes Cash Plus balance and other special funds.

9. How long does a fund transfer take?

Funds are expected to arrive within 1–2 working days. As public holidays differ between Hong Kong and Singapore, the actual processing time depends on the working days of the destination broker.

Disclosures

This article is for reference only and does not constitute any investment advice.