How can we help?

What is Grid Trading?

Grid trading is a trading strategy based on the fluctuation of stock price, which sets the strategic parameters and the system executes buy low and sell high according to the parameters to earn the band difference.

In advance, investors allocate their assets into distinct portions and establish a reference price. They then create a corresponding grid that takes into account the price variations above and below this benchmark. Should the stock price decline, activating the grid, they purchase a portion at the predetermined price and quantity. Conversely, if the stock price rises and triggers the grid, they sell a portion, capitalizing on the price differential through a cycle of buying and selling.

How do I submit a grid trading order?

Select "Grid trade" as the order type within the transaction window.

Input the price and quantity parameters as per the interface instructions, then proceed to submit the strategy.

Once the submission is done, you will find the respective grid strategy record on the individual stock details page, allowing you to click and access the strategy order details directly.

Additionally, you can view strategy order records, along with related transactions and the profit and loss status, on the asset homepage or the order record page.

In cases where the strategy is not aligned with the prevailing market trend or when monitoring needs to be temporarily halted for any other reasons, you can click on the strategy sheet and opt to either pause the operation or cancel it directly. If you require adjustments to the strategy parameters, you can click 'Modify' to make the necessary changes.

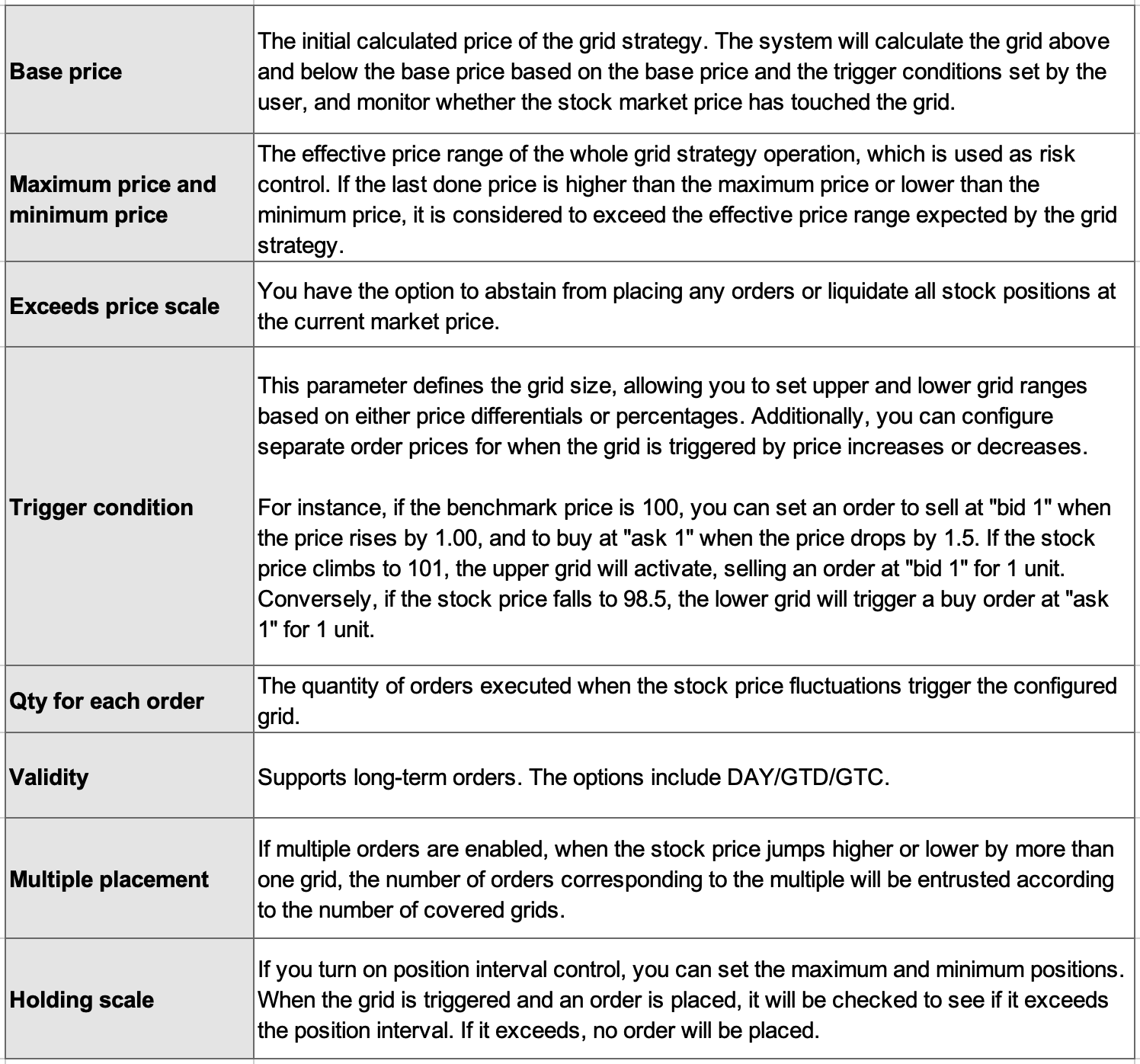

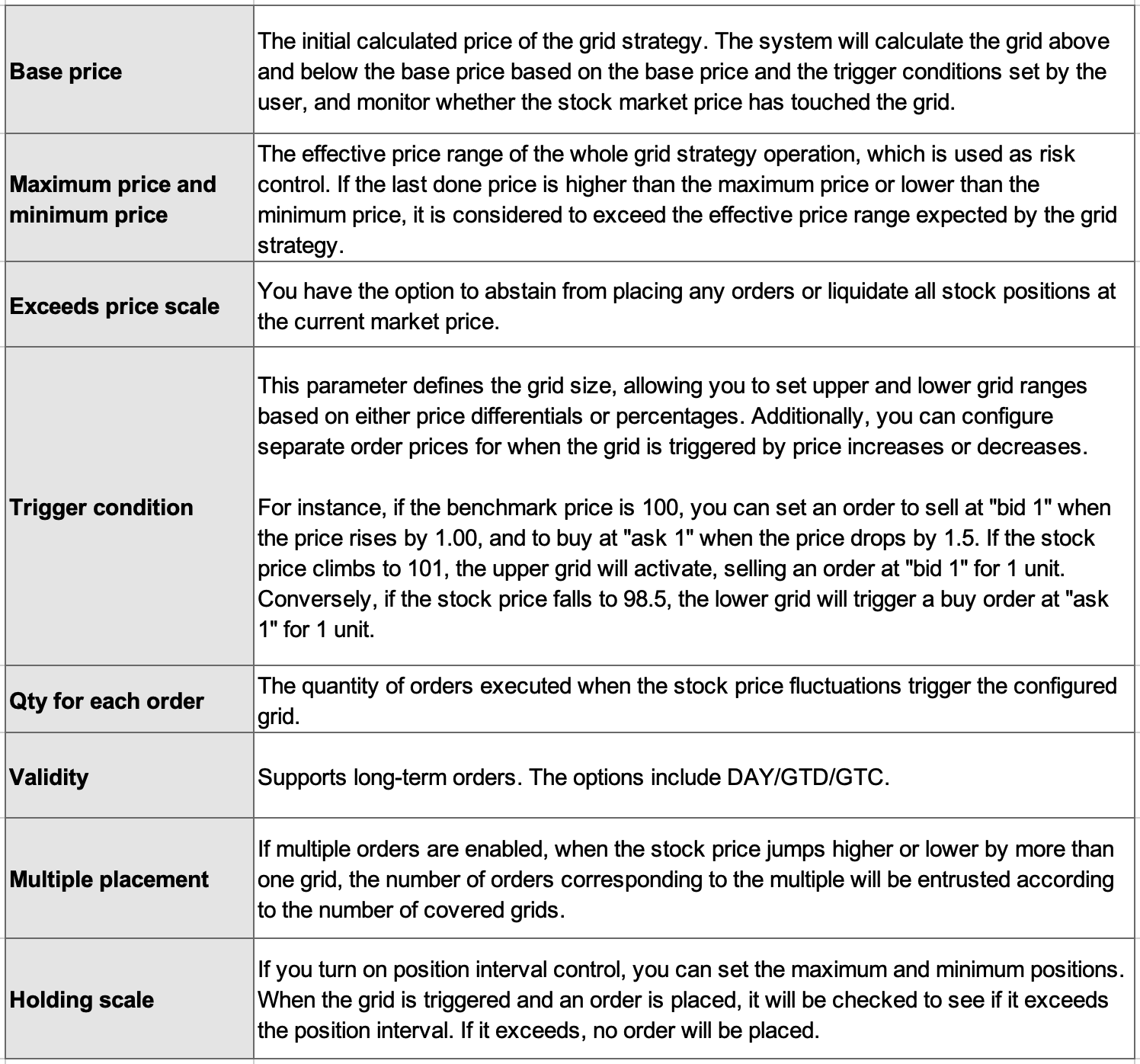

How to set grid trading parameters?

Note: Grid trading does not support pre-market/after-hour trading of US stocks and auction trading of HK stocks.